Denial Explanations

- Applicant requested to withdraw

- Applicant previously received IHAF assistance

- Applicant submitted a duplicate application

- Applicant does not have an eligible COVID-19 hardship

- Applicant income exceeds the limits of this program

- Applicant not applying for primary residence

- Applicant’s loan is greater than the conforming loan limit in effect at time of origination

- Applicant has an ineligible property type

- Applicant’s primary residence is not in Indiana

- Applicant has an invalid mortgage or more than one mortgaged property

- Applicant has a land contract

- Applicant is ineligible for IHAF assistance

- Applicant withdraws to seek alternative loss mitigation / resolved through non-monetary assistance

- Applicant’s home sold in sale

- Applicant is missing documents / unresponsive

- Applicant’s lender not participating

- Applicant has a reverse mortgage

- Applicant’s assistance exceeds $50k (homeowner unable/unwilling to contribute)

- Applicant’s debt-to-income exceeds 38%

- Applicant is current

- Applicant’s lender objected – Trial modification

- Applicant’s monthly first mortgage payment is less than 25% of gross household income

Applicant requested to withdraw

- Explanation: The applicant requested to withdraw from IHAF application review.

- Example: John Doe contacted the IHAF call center and informed a call center specialist that they accepted a new job in a different state and would be selling their home. John Doe no longer wished to be considered for assistance.

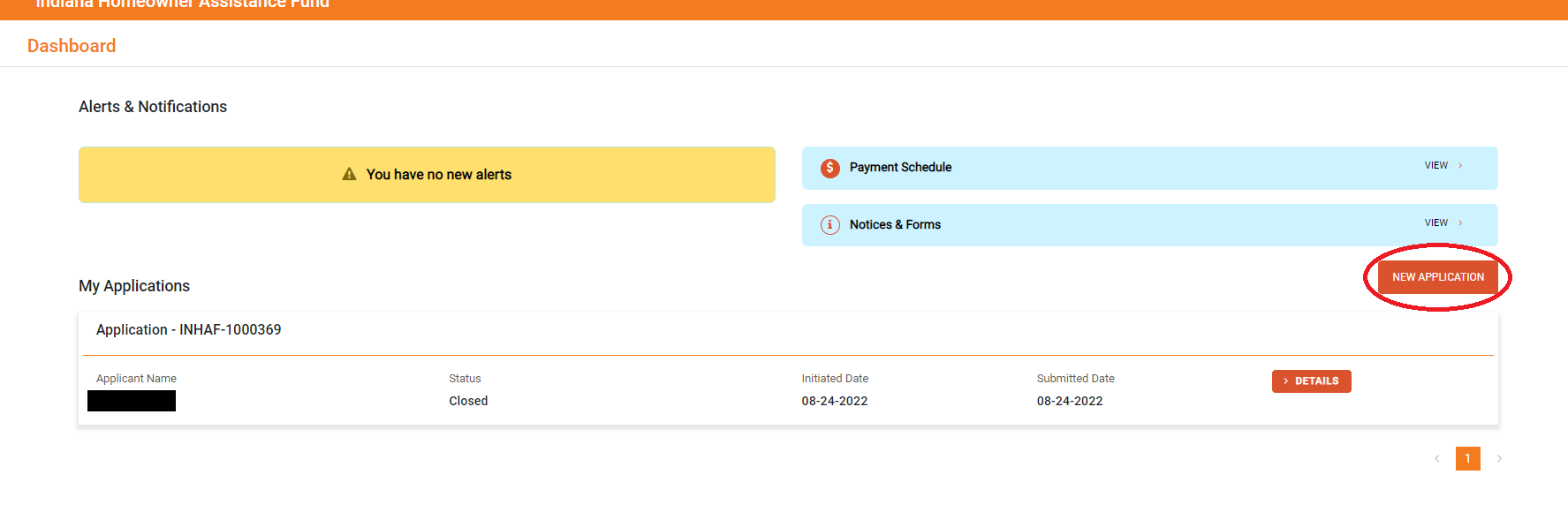

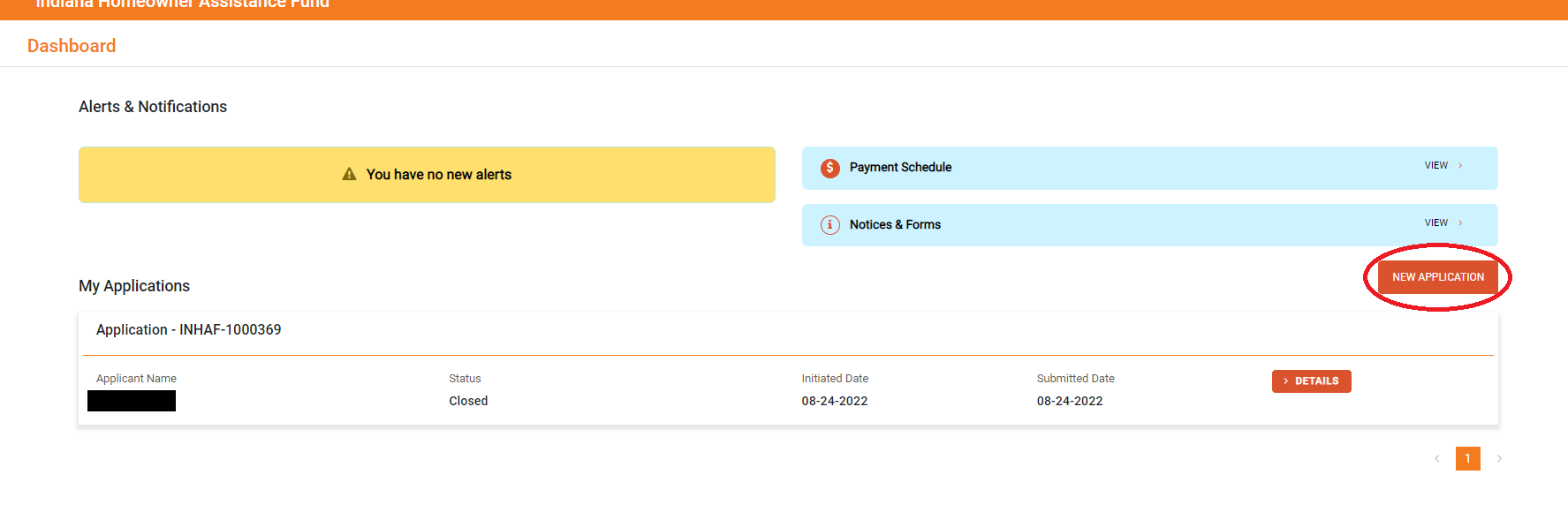

- Corrective Steps: If the applicant changes their mind, they are eligible to reapply once for IHAF assistance by logging in to the applicant portal and clicking “New Application.”

Applicant previously received IHAF assistance

- Explanation: A household is only eligible to receive IHAF assistance once.

- Example: John Doe received IHAF assistance in September 2022. Jane Doe, who lives in the same household, applies for assistance in March 2023. Jane Doe is ineligible to receive assistance, even though she has not applied before, because her household has already received IHAF assistance.

Applicant submitted a duplicate application

- Explanation: An applicant may only apply for IHAF assistance twice, receive assistance once, and may only have one application under review at a time.

- Example: John Doe submits an IHAF application in September 2022. While his first application is still under review, he submits a second application in October 2022. The second application will be denied as a duplicate application.

- Corrective Steps: The applicant should wait until a decision is made on their first application before submitting a second application. If their first application is denied, they may be able to reapply. Applicants should call 877-GET-HOPE (877-438-4673) for more information.

Applicant does not have an eligible COVID-19 hardship

- Explanation: To be eligible for IHAF assistance, applicants must have experienced a financial hardship associated with the COVID-19 pandemic. This can include increases in expenses or decreases in income. Examples can be found in the IHAF FAQ.

- Example: John Doe only selected the “I did NOT experience a reduction in income” and “I did NOT experience an increase in expenses” checkboxes when applying. Jane Doe selected “Other” and stated she experienced an increase in expenses due to pregnancy. Neither of these applicants would meet the COVID-19 hardship requirement.

- Corrective Steps: Applicants have seven days to appeal the decision. As part of their appeal explanation, the applicant will be required to provide additional details regarding any COVID hardships they may have experienced.

Applicant income exceeds the limits of this program

- Explanation: Household gross income cannot exceed 150% of the county Area Median Income (AMI) or 100% of the National Median Income, whichever is greater. The gross income of all adult household members is included when calculating household income, regardless of if they own the home. Overtime, bonuses, and any other forms of compensation must be included in the calculation. The Department of Housing and Urban Development (HUD) determines Area Median Income. AMIs for all counties can be found here. This is a Federal requirement for the IHAF program.

- Example: John Doe stated their income is $15,000 per week, $780,000 per year. This exceeds the 150% AMI level. John Doe would be denied.

- Corrective Steps: Applicants have seven days to appeal. If the applicant believes their income was calculated incorrectly or that they made an error when completing the application, they may state so in their appeal explanation. An appeals analyst will recalculate their income and request updated income documentation if needed. Applicants should also confirm that they listed all household members when they initially applied as income limits are calculated by household size.

Applicant not applying for primary residence

- Explanation: An applicant may only receive IHAF assistance for the home that is their primary residence. A household is considered an applicant’s primary residence if the applicant resides in the residence for at least six months per year.

- Example: John and Jane Doe have a summer house in Florida and a home in Indiana. The Florida home is fully paid off. They spend seven months a year in Florida and five months a year in Indiana. The Indiana household is ineligible for assistance because it is not their primary residence.

- Corrective Steps: Applicants have seven days to appeal. If the applicant disagrees with the primary residence determination, they should provide additional information in their appeal explanation. They may also be required to provide supporting documentation including bills, identity documents, mail, and prior tax returns.

Applicant’s loan is greater than the conforming loan limit in effect at time of origination

- Explanation: The applicant’s principal balance at the time of purchasing the home cannot exceed the conforming loan limits in effect at the time. Conforming loan limits can be found here. This denial reason is most often due to the homeowner having a jumbo loan. A jumbo loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan.

- Example: John Doe purchased his home in 2011 using a $500,000 mortgage. This exceeds the conforming loan limit in 2011 which was $419,000.

- Corrective Steps: John Doe is ineligible for IHAF assistance.

Applicant has an ineligible property type

- Explanation: All property types are not eligible for IHAF assistance. Manufactured or mobile homes that are not permanently affixed to land and taxed as real estate are ineligible for assistance. If an applicant pays lot rent, they are ineligible for assistance.

- Example: John Doe resides in a manufactured home. The home is not on a permanent foundation and is not taxed as real property. John Doe pays lot rent. He is ineligible for IHAF assistance.

- Corrective Steps: Applicants must provide proof that the property is taxed as real estate and permanently affixed. This could include tax bills, appraisals, mortgages, or other documentation. Applicants should first consult with the manufacturer of their home or the company the home was purchased from.

Applicant’s primary residence is not in Indiana

- Explanation: Homes that are not located in Indiana are ineligible for IHAF assistance.

- Example: John Doe lives in Louisville, KY but commutes to Indiana for work.

- Corrective Step: John Doe is ineligible for IHAF assistance because his primary residence is located in Kentucky. Applicants should contact the homeowner assistance fund program for the state they live in.

Applicant has an invalid mortgage or more than one mortgaged property

-

Explanation: Not all types of mortgages are eligible for IHAF assistance. Please consult the IHAF FAQ for more information. Applicants are ineligible for assistance if they own more than one mortgaged property. Applicants who own multiple properties are eligible for assistance if only one of the properties they own has a mortgage.

- Example 1: John Doe has an open Home Equity Line of Credit (HELOC) from which he can withdraw funds.

-

Corrective Steps: John Doe is ineligible for IHAF assistance.

- Example 2: Judy Doe has a closed HELOC and is unable to withdraw funds.

-

Corrective Steps: Jim Doe must provide documentation from their bank confirming the HELOC is closed and that they are no longer able to draw upon it. If they can do so, they may be eligible for IHAF assistance.

- Example 3: Jane Doe owns two properties both of which have mortgages.

-

Corrective Steps: Jane Doe is ineligible for IHAF assistance.

- Example 4: Jack Doe has a reverse mortgage.

- Corrective Steps: Jack Doe is ineligible for mortgage assistance but may still be eligible for assistance with property taxes, homeowner’s insurance, and/or homeowner association fees.

Applicant has a land contract

- Explanation: Applicants with a land contract are ineligible for IHAF assistance. A land contract is an agreement where the seller finances the buyer’s purchase of real estate. The buyer makes regular payments to the seller over a period, but the deed does not transfer until the last payment is made.

- Example: An applicant may have a land contract if they are making payments directly to the seller, the seller is acting as a lender, and the applicant has possession of the property, but the seller holds the title.

- Corrective Action: To be eligible, the buyer and seller will have to take several actions. The seller must transfer title to the buyer and record the transfer at the county recorder’s office. Next, the seller must record the mortgage at the county level. The lender (formerly the seller) must onboard with the IHAF program and agree to all required terms to receive payment. For more information, visit https://www.877gethope.org/ihaf-servicers or contact 877-GET-HOPE (877-438-4673).

Applicant is ineligible for IHAF assistance

- Explanation: This application was denied for a reason that does not fall under a currently existing denial reason.

- Corrective Steps: For more information, please call 877-GET-HOPE (877-438-4673).

Applicant withdraws to seek alternative loss mitigation / resolved through non-monetary assistance

- Explanation: The applicant requests to withdraw to seek a different type of assistance.

- Example: John Doe, after speaking with their housing counselor, decides to withdraw from the IHAF program and instead seek a different form of loss mitigation assistance through their servicer.

- Corrective Steps: If the applicant changes their mind, they are eligible to reapply once for IHAF assistance by logging in to the applicant portal and clicking “New Application”.

Applicant’s home sold in sale

- Explanation: While their application is under review, the applicant sells their home. Because the applicant no longer owns the property, they are not eligible to receive assistance.

- Example: John Doe sells his property after applying for assistance.

- Corrective Steps: John Doe is no longer able to receive assistance for the home in his initial application. The applicant may still be able to receive assistance with a new home that they’ve purchased but must submit a new application.

Applicant is missing documents / unresponsive

-

Explanation: If applicants are missing documentation or additional documentation is required, an email will be sent to the homeowner specifying the document(s) that need to be provided. If multiple documents are requested, you will receive a separate email for each request. In some rare circumstances, applicants may receive the same document request more than once. In this situation, it is important for the applicant to respond to each request and upload the requested documentation, even if they have already done so. Upon receiving a request for additional documentation, applicants have 10 days to respond. If an applicant does not provide the requested information within 10 days, the application will be closed.

- Requests are sent to the same email the applicant used to apply for assistance. The email will come from inhaf-noreply@speridian.com.

- Document request emails will include a link to the applicant portal that can be used to upload documentation. If you are unable to upload your documentation, you can email it to haf@b-l-n.com or contact 877-GET-HOPE (877-438-4673).

- Additionally, once an applicant is approved for IHAF assistance, they must schedule a closing appointment with IHCDA’s closing partner, Statewide Document Services. These requests are made via phone and email. If the applicant does not schedule a closing appointment within 7 days of Statewide’s initial contact attempt, they will be denied.

- Example: John Doe submitted an application but forgot to include all required income documentation. A case manager identified this and sent an email to John Doe requesting additional paystubs. John Doe did not respond to the request for additional paystubs. Autogenerated follow-up email requests were sent, and John Doe was unresponsive to those as well. After 10 days, John Doe's application was closed.

-

Corrective Steps: Applicants must check their email, including spam folders, frequently for communication from IHAF staff, including document requests.

- If you have the requested documentation, contact your housing counselor, if you have one. If you do not have a housing counselor, email the documentation to haf@b-l-n.com or contact 877-GET-HOPE (877-438-4673). If you are unable to upload your documentation through the application portal contact haf@b-l-n.com or 877-GET-HOPE (877-438-4673).

Applicant’s lender not participating

- Explanation: An applicant’s servicer or lender must agree to participate in the IHAF program. If they refuse to participate, IHCDA is unable to provide mortgage assistance.

- Corrective Steps: Applicants can contact their servicer and request that they participate in the program. Applicants with servicers who are unwilling to participate may still be eligible for property charge assistance.

Applicant has a reverse mortgage

- Explanation: Reverse mortgages are ineligible for IHAF mortgage assistance. However, applicants with reverse mortgages may still be eligible to receive property charge assistance.

- Example: John Doe has a reverse mortgage. He did not indicate in his application that he needed assistance with property charges.

- Corrective Steps: John Doe is ineligible for mortgage assistance but may still be eligible for assistance with property taxes, homeowner’s insurance, and/or homeowner association fees. property charges. In his appeal he can indicate that he would like to be considered for property charge assistance even though he did not initially request any.

Applicant’s assistance exceeds $50k (homeowner unable/unwilling to contribute)

- Explanation: Households are eligible to receive up to $50,000 in IHAF assistance. Some applicants, depending on eligibility criteria, may be eligible to contribute their own funds if the amount of assistance needed exceeds $50,000. IHCDA will contact homeowners who meet eligibility requirements to contribute funds. To be eligible to make a homeowner contribution, applicants must meet the reinstatement eligibility requirements (38% debt-to-income ratio). Applicants who do not meet the eligibility requirements will be ineligible for assistance if the reinstatement amount exceeds $50,000, even if the applicant has funds available to contribute. If an applicant is eligible for a homeowner contribution, they must follow IHCDA’s instructions and meet the stated timelines.

- Example: John Doe’s reinstatement amount is $55,000. John Doe meets the reinstatement eligibility requirements and is eligible to submit a cashier’s check or money order to IHCDA for the excess amount ($5,000). The homeowner must inform a case manager that they are able to make the contribution. Payment must be received by IHCDA within 10 calendar days of notification.

- Corrective Steps: Applicants have seven days to appeal a denial. If the applicant now believes they can make a homeowner contribution, they should include this in their appeal explanation. An appeals analyst will contact them to discuss their case. However, it is possible that the amount to contribute increases while the appeal is under review.

Applicant’s debt-to-income exceeds 38%

- Explanation: IHAF programs (reinstatement and monthly assistance) have individual eligibility criteria. To receive reinstatement-only assistance, the applicant must have a debt-to-income (DTI) ratio that does not exceed 38%. DTI is calculated by dividing the applicant’s monthly gross household income by their monthly mortgage payment. If the result is greater than 38%, they are ineligible for reinstatement-only assistance. Please note – you may be denied for one program while remaining eligible for another. Please make sure to read all program correspondence. Any approval or denial letters you receive will specify the applicable program.

- Example: John Doe is applying for reinstatement-only assistance. His monthly mortgage payment is $600. His gross household monthly income is $1,500. His DTI is 40% ($600 divided by $1,500). He is ineligible for reinstatement-only assistance.

- Corrective Steps: Applicants have seven days to appeal if they disagree with the denial. Applicants should confirm they included all sources of income for their household as additional income will lower an applicant’s DTI.

Applicant is current

- Explanation: The applicant’s servicer indicated that their loan was current. This means there is no delinquency for IHAF to reinstate. The applicant is not behind on their mortgage. However, you may still qualify for monthly or property charge assistance.

- Example: Jane Doe applied for reinstatement assistance through IHAF. IHAF staff contacted her lender to obtain the delinquency amount for Jane’s loan. Jane’s lender stated Jane’s loan is current, and there is nothing to reinstate.

- Corrective Steps: Applicants have seven days to appeal if they disagree with the denial. If an applicant disagrees with the servicer’s determination, they should state so in their appeal explanation. In some circumstances, a servicer may report an applicant’s loan is current if it has been transferred or matured.

Applicant’s lender objected – Trial modification

- Explanation: A trial modification is a form of loss mitigation offered by servicers. They can last anywhere from one month to one year and are meant to prove that a homeowner can sustain new mortgage payments. IHAF is unable to provide assistance if a homeowner is already receiving another form of loss mitigation. Therefore, IHAF assistance cannot be provided while a homeowner is in the middle of a trial modification.

- Example: John Doe applies for assistance in September 2022. In November 2022, John Doe agrees to a trial modification with his servicer. His servicer subsequently objects to his assistance in December 2022 because he has entered in a trial modification.

- Corrective Steps: An applicant has two options if they are in a trial modification. The applicant may decline the trial modification and reapply for IHAF assistance, or they may complete the trial modification and apply for assistance once the trial modification is completed. If the applicant completes the trial modification, they will be current, but they may still be eligible for property charge or monthly assistance.

Applicant’s monthly first mortgage payment is less than 25% of gross household income

- Explanation: IHAF programs (reinstatement and monthly assistance) have individual eligibility criteria. To be eligible for reinstatement and monthly assistance or monthly-only assistance, an applicant must have a monthly mortgage payment that is equal to or greater than 25% of the applicant’s monthly gross household income, excluding any unemployment benefits a household member may receive. This is calculated by multiplying the applicant household’s gross monthly income by 25% and comparing it to their monthly mortgage payment. If the monthly mortgage payment is less than 25% of the applicant’s gross monthly income, the applicant is ineligible for reinstatement and monthly or monthly-only assistance. Please note – you may be denied for one program while remaining eligible for another. Please make sure to read all program correspondence. Any approval or denial letters you receive will specify the applicable program.

- Example: John Doe has a gross monthly income of $4,500 and a monthly mortgage payment of $550. Twenty-five percent of his gross monthly income is $1,125. His monthly mortgage payment is $550. This is less than $1,125. He is ineligible for reinstatement and monthly assistance, as well as monthly-only assistance. However, John Doe may still be eligible for reinstatement-only assistance.

- Corrective Steps: Applicants have seven days to appeal. If your income has changed since the time of application this may result in a change to your eligibility. Please reference any such changes in your appeals explanation. You may need to submit additional income documentation.