Indiana’s Homeowner Assistance Fund (IHAF)

Information for Providers

Mortgage Servicers, County Treasurers, Insurers, HOAs

The Indiana Homeowner Assistance Fund (IHAF) is a federally funded housing assistance program for Hoosier homeowners impacted by COVID-19. It was created to provide funds to eligible homeowners for housing-related costs such as mortgages and property expenses.

The Indiana Housing and Community Development Authority (IHCDA), in partnership with the Indiana Foreclosure Prevention Network (IFPN), is administering IHAF through services provided by Beam, Longest and Neff (BLN) to manage the program and its online administration system for providers.

This web page has been set up to provide basic information to providers about IHAF, including training opportunities and the mortgage servicer onboarding form or the provider onboarding form to participate in the program. Mortgage servicers must also review and sign the IHAF Servicer Agreement. Please send all signed forms and agreements to BLN by clicking on this email.

If you are a homeowner looking for mortgage help, please apply for assistance by visiting 877GetHope.org, which is the official website for IHAF.

First steps for Providers

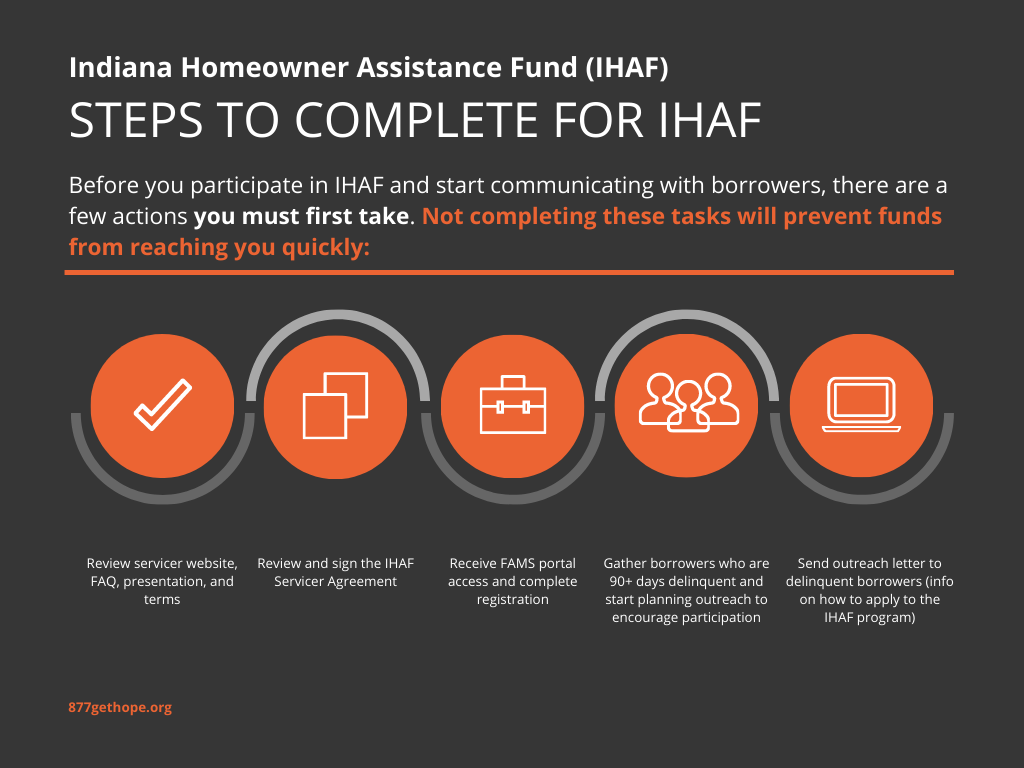

Providers interested in participating in the IHAF Program should take the following first steps:

Read the FAQ: The FAQ for providers gives an overview of the IHAF Program, what providers must do to participate and basic information that providers should know when speaking with homeowners applying for the program. Providers should also review the IHAF outreach letter to borrowers and the IHAF one-pager.

Complete & return IHAF Servicer Agreement (if applicable) and onboarding forms: All providers must complete the provider onboarding form or the mortgage servicer onboarding form to participate in the program. Mortgage servicers must also review and sign the IHAF Servicer Agreement. Please send all signed forms and agreements to BLN by clicking on this email.

IHAF Webinar/Trainings: Introductory trainings for providers will give information about the program's design and goals, homeowner eligibility and eligible uses of funds. They will also discuss the role of the provider, including registering for the program, using the online portal, required documentation, data exchange, communication and the service level collaboration agreement.

- PowerPoint: IHAF Overview for Providers

- Troubleshooting Guide: Provider Portal and Consumer Data File Troubleshooting Guide 07.12.22

- CDF Data Dictionary: CDF Data Dictionary.xlsx

Role of Providers

Providers will play a critical role in the success of the IHAF Program. IHCDA is in the process of establishing an online portal for providers to participate in the IHAF Program. This portal - known as the Financial Aid Management System (FAMS) - will allow providers to exchange critical information with IHCDA and its vendor. Read the FAQ for providers for more information about FAMS.

Providers will be able to submit their onboarding information, service agreements, and payment information, as well as set up a secure File Transfer Protocol (FTP) channel to send/receive Common Data Files (CDF).

Homeowner Eligibility

To qualify for IHAF assistance, homeowners will need to complete an application and demonstrate that they:

- Have experienced a COVID-related impact to their finances on or after January 21, 2020, that caused them to miss regular mortgage payments. The hardship could include job loss, reduction in income, reduction in hours worked, increased costs due to healthcare, increased costs due to the need to care for family members, or other issues which have impacted the household’s income.

- Are owner-occupants of a single-family home, condominium, or 2- 3- or 4-family dwelling, or manufactured homes permanently affixed to real property located in Indiana. (Funds may not be used for owner-occupied properties of five or more units, investor-owned properties, or vacation homes.)

- Are using the home as their primary residence.

- Have an income equal to or less than 150 percent of Area Median Income (this differs by region and household size).

- Have a conforming loan and not a jumbo loan (loan limits vary by region).

Eligible Uses of Funds

IHAF assistance may be used in a variety of ways including, but not limited to, the following:

- To bring a homeowner’s loan current (pay outstanding monthly mortgage payments).

- To provide ongoing monthly mortgage payment assistance.

- To pay for outstanding escrow items (taxes, insurance and HOA dues).

More Information

IHAF was created by the American Rescue Plan Act (ARPA) and is being funded by the United States Department of the Treasury. The Indiana IHAF Program is being administered by the IHCDA in partnership with the IFPN, through services provided by BLN to manage the program and its online administration system for providers.

For more information, email HAF@b-l-n.com